Features

Take a tour of our platform

GST Compliance made easy

GST with Consult GST Online

Changing paradigm for tax payers

Tax and Technology are the changing paradigm for tax payers and government. In GST regime, technology can help create a credible deterrence for tax evaders. To comply with the GST system, we act as an ASP (Application Service Provider) to make your journey easier.

Wide array of GST services

Wide array of services provided never before by any single organization

We are an ASP (Application Service Provider) for implementing GST with wide array of services provided never before by any single organization. We are providing end-to-end GST Compliance Services which ranges from invoice generation to appeals.

Focus on your core business

You need not to become an IT Professional to comply with GST

As we are aware that the backbone of the GST system is based on technology. We make it easy for our customers to focus on their core Business areas while technological challenges are taken care by our team. You need not to become an IT Professional to comply with GST. You only focus on your core business, let it be on our side.

Return Filing and Reporting

GST Return filing on our platform is as easy as a-b-c.

Using our platform features to make GST Compliance more captivating and flexible. By using our system, we will take every care for filing your returns on-time, every-time. You just relax! You can view your returns & other reports at any time.

Save your Time, Money, & Energy

Use Consult GST Online to create GST Returns by few clicks!

We offer solutions for 360 degree GST Implementation. It starts from collection of invoices (inward/outward) to final tax payments and beyond that. We always strive hard to save your TIME, MONEY and ENERGY by automating the process flow. You can fulfill all GST Compliance without any technical knowledge.

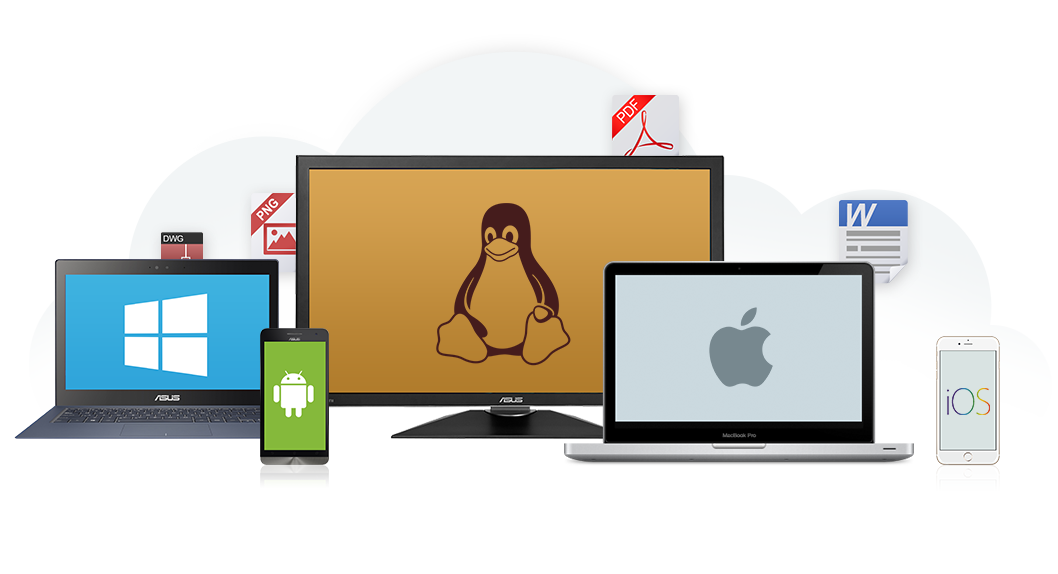

Cloud-based platform for GST: Elegant, Powerful and Easy-to-Use

Desktop App

GST Invoicing App for invoice generation and synchronization of data

By using our Desktop App, you can easily record your business transactions. It's a full-featured Invoicing application to generate invoices based on the nature of business. It can be customized as per your need & convenience.

Mobile App

Access the full feature Invoicing app via mobile devices

We have an alternate of using your mobile device as POS terminal. By using our mobile app you can access the full feature Invoicing app via mobile devices such as phones and tablets. Each type of device has its own customized interface. Download apps from the App Store and Google Play for any type of device which you are using.

ERP/Accounting System Integrations

Integrate with a wide variety of Accounting/ERP Systems

Our GST platform integrates with a wide variety of systems, including Tally, Busy, SAP, Microsoft Dynamics, and more. Our data import tool enables importing of data from external business systems in multiple formats and then processing the data for return filling.

Manual Data Collection

You do your business in your way, we will collect manual data too

If you are not having any of the way (Desktop/Mobile), to record your business transactions, we are offering a unique way of making you GST Compliance. Now, you can send us the data manually (invoice copies) or our representative will collect the same to record your data for filing returns.

Consult GST Cloud

Access your data or information, anywhere, anytime!

We are an ASP in GST workflow, who will focus on taking taxpayers' raw data on sales and purchases and converting it into the GST returns. Our cloud user interface is elegant and intuitive, which keeps users happy and engaged, and makes the whole experience of using the solution more productive and enjoyable. We designed our cloud system so that it's easy to use without referring to online help or guides.

Information at your fingertips

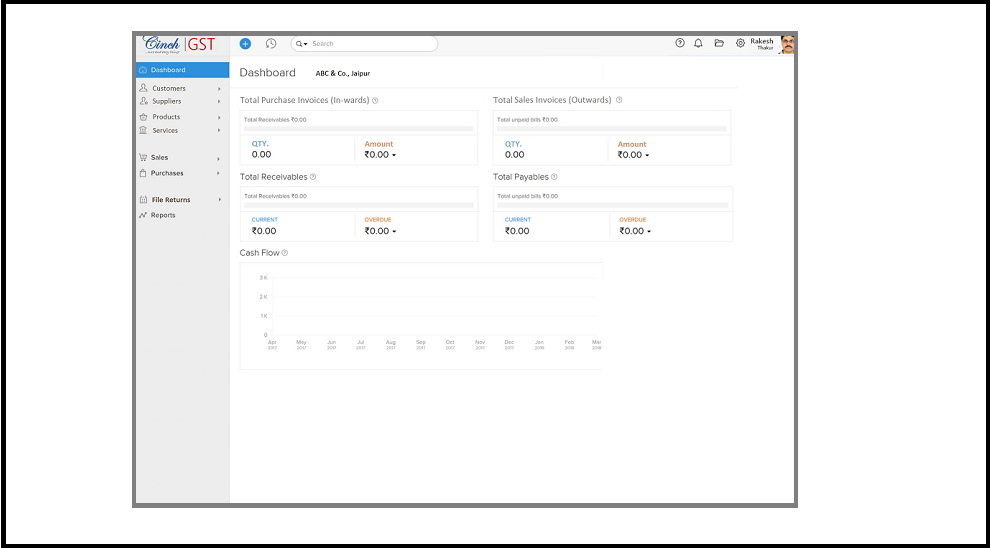

MIS Dashboard

Graphic dashboards for traders, tax practitioners and consultants to access important information

We provide beautiful graphic dashboards for traders, tax practitioners and consultants that offer a single-page view of the most important data related to GST. Traders/Tax payers can keep track easily of their transactions and returns, by checking their dashboards which shows transaction status, reconciliation status, and returns.

Smart Systems for SMEs

See all your important information at once

Our solution helps you to get MIS Dashboard to view graphical representation of paid invoices, outstanding invoices, overdue invoices across both receivables and payables. It require minimal manual inputs for populating maximum information for invoice preparation as per GSTN recommended format.

Real-time Consultancy by Tax Practitioners

Fast, reliable and real-time consultancy to make you GST compliance with event pop-up

All sales/purchase data synced on cloud and accessible to your Tax Consultant/CAs at a single click. Soon after you enter your data/sync data, an event pop-up get displayed on the basis of which, the consultant can advise you the required action at your end to make you GST Compliance. So that you will never be on wrong path.

GST Returns & Reconciliation

Track inward and outward data electronically, to file returns with convenience

After getting the required data on our Cloud, we can prepare your Returns. Our systems are integrated with GSTN to process GST returns & do reconciliations of data from other parties.

Data Import/Export

Smooth data import and export from your favorite accounting systems

By using our Import/Export tool, you can import data from you accounting application/ERP system for GST Return Filing by a single click. Also, you can export the sales/purchase data from our Invoicing Tool to your accounting application to finalize the accounting books.

Tax Consultants: real substance of the GST

Tax Consultants

The driving force behind GST working system

The role of tax professionals is vital in GST system to ensure that interpretation of the GST regulation is in sync with the real substance of the GST law. Also, the introduction of GST in India opens up a new horizon for Tax Consultants. It is imperative that such practitioners keep their advisory knowledge up-to-date in the current dynamic environment, so as to help clients mitigate any issues relating to business impact assessment that arise from the implementation of GST. Tax practitioners will also be expected to represent clients' concerns before the appropriate authority.

Advocacy & Advisory

Advisory is the heart of GST system, it's a need of hour

GST in India will usher in various regulatory changes and affect how definitions are perceived by taxation authorities vis-à-vis taxpayers. Although the GST aims to simplify the whole indirect taxation process, there exist certain procedural lacunae during the transition period that can jeopardize the entire change-management process. In this scenario, the tax practitioners can provide advocacy and advisory services.

Increase in Compliance Needs

Increase in Tax Payers, Increase in Compliance Needs

In the GST regime, it is estimated the number of tax payers to 8 Million to start with and projected to grow beyond 12 Million. Most Tax Payers will now move to monthly compliance process. The new law, transition need open up a vast service area for the Tax Consultants.

Business Structure: Redefined

Sync your business process with the regulations of GST

With the advent of GST, the entire gamut of accounting codes and guidelines will need to be revamped to be in sync with the regulation of GST. A modification of this magnitude will pose a severe challenge to commercial enterprises and individuals, who will have to re-establish entire operations from scratch.

Client base: Retention & Expansion

Do Less, Achieve More!

We have a fast, reliable, and automated GST Compliance system by which Tax Consultants can retain their existing clients and expand their arm to serve more clients at the same time. The industry will likely need assistance in registration as well as maintenance of tax records under the GST; a business entity would be unwise to approach filing/completion of requisite forms and documents without the aid of a professional.

Communicate, network and collaborate

Resources library

Use our rich set of GST resources for personal use or share them with your colleagues

By using our resource library, you can get access of the rich set of GST information, current GST updates, and other useful links to get insights of GST System. As we are aware that, GST is still in evaluation phase. Using our resources, you can also communicate, network and collaborate with other traders, tax practitioners and consultants to get the current updates on GST.

GST Guides

Know everything about GST

You can always be updated about GST by visiting our GST Guides section. In this section, you will always find the latest information about GST.

GST Learning Videos

GST System, see it Live!

We have rich sets of learning videos about GST & other system workflows. You can get the knowledge of the various operations under GST systems, such as invoicing, input credits, return filing, and many more.

GST Infographics

Your visual guide to GST System

Infographics are the best method to explain any complex system process. Using GST Infographics, you can easily understand the step-by-step process to accomplish any task into GST System.

Messaging & Collaboration

Communicate with all stakeholders at your convenience

We have created a blog site for various communities who are part of GST system. By using this blog site, they can communicate with other stakeholders. We have bidirectional email integration, so you can receive messages via email and respond via email as well.

Some more useful features

Access GST Data on Any Device

Access your data any-time, any-where, every-where!

Get your sales data, purchase data, returns, and almost all information related to GST at any-time, any-where, every-where.

Admin Control

Administer every aspect of your GST Compliance

It's simple for a single person to administrate a large business. All administrator options are available via a single pop up menu, and each administrative feature has very nominal user intervention. We also provide Tax Consultant support by default who is another level of administrator accounts, so all GST information can be managed professionally.

Monitoring

Monitor your data effectively

By using our system, you can monitor your data and information. You will always be informed with the current issues & deadlines. Easy and effective monitoring tool is integrated with the system to eliminate the challenges.

Help center

Well-organized, searchable help, with access to our rapid response support team

Searchable help center with topics organized by various process type. Detailed instructions with screenshots for most topics. One-click access to the support forum, discussions forum, suggestions area, how to videos, getting started guides, and roadmap.